How do I obtain an Exchange Traded Options (ETO) quote?

Before requesting an Exchange Traded Options quotes, it is important to know:

- The top bid/offer may be an order by someone other than a market maker. In this circumstance the best, worst and midpoint will not be accurate reflections of the "market maker derived price".

- Market makers are not required to respond to every quote request.

- Market makers generally respond to quote requests within 5-10 seconds, but may take up to 30 seconds to respond (if they respond at all).

- Quotes will generally stay in market for approximately 30 seconds.

- Quotes will generally stay in market for approximately 30 seconds.

- Some options may be continuously quoted and requesting a quote will not change the depth.

- Each underlying share can be covered by one or many market makers.

Explore the important definitions that are crucial when investing in ETOs:

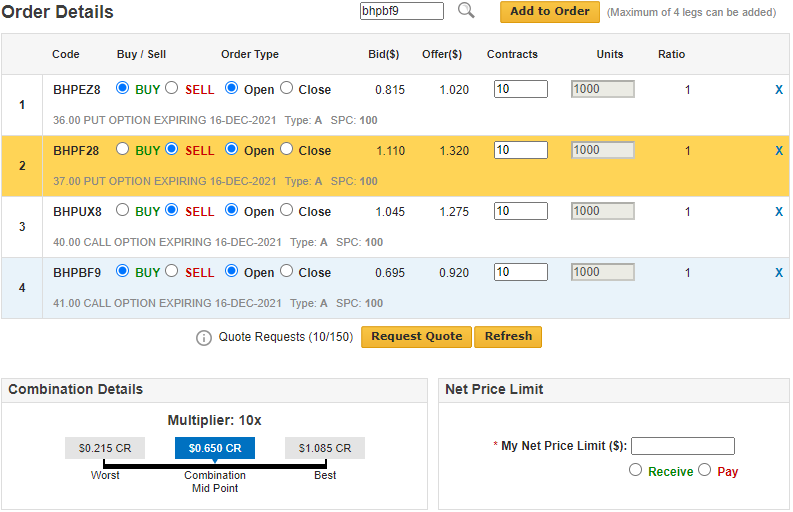

Best: The theoretical "best price" you could achieve on the order right now. This is calculated using the bid of all buy legs and the offer of all sell legs.

Worst: The theoretical "worst price" you could achieve on the order right now. This is calculated using the offer of all buy legs and the bid of all sell legs.

Mid-Point: Halfway between the theoretical best and worst prices you could achieve on the order right now. This is calculated as (Best + Worst) /2 OR halfway between the bid & offer of each leg.

Learn more about the ASX ETO Market Maker Scheme.

Please note: there are two different ways to request ETO quotes - from the single-leg order pad and the multi-leg order pad.

How to request a quote from the single-leg order pad:

1. After logging in, click on Trading > Options > Options Order. (Note: you need an ETO account to be able to access this).

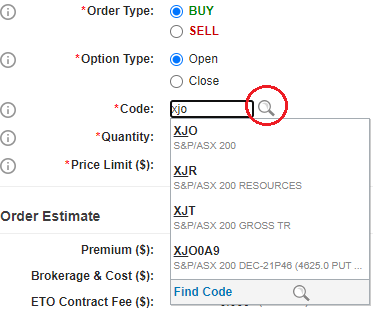

2. If you know the Options code, skip to step 4. If you don't know the Options code and need to search for a specific Options series, enter the underlying code (e.g., BHP or XJO) and click the magnifying glass to search.

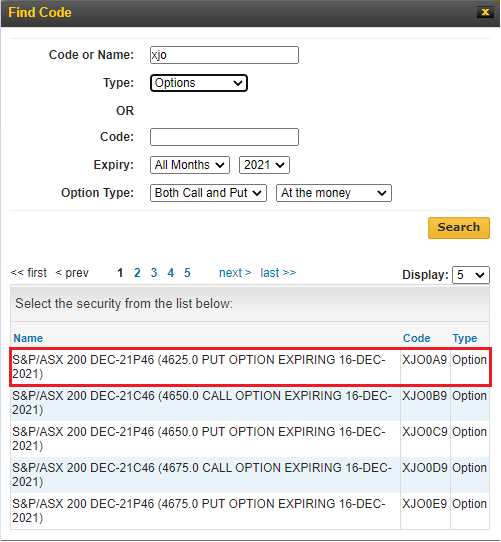

3. Under type select Options and use the various search filters to find the Options series you wish to trade. From the list, click on the Options series that you are interested in to add it the order details screen.

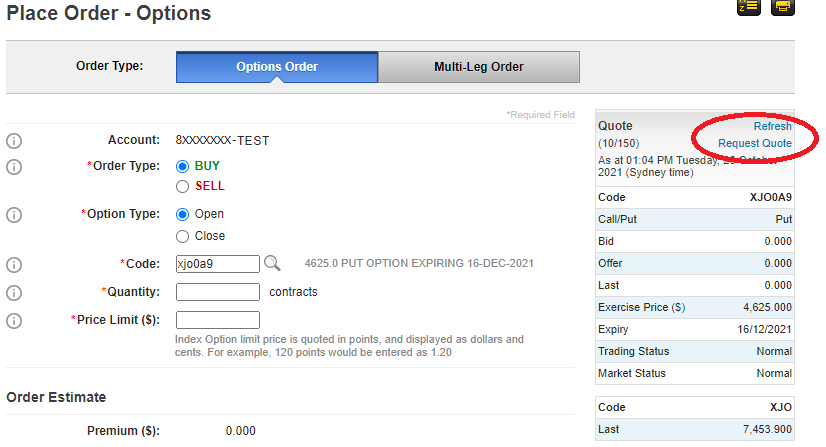

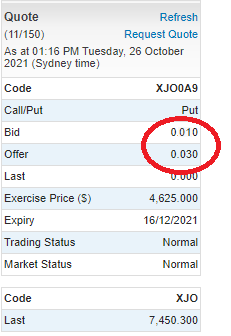

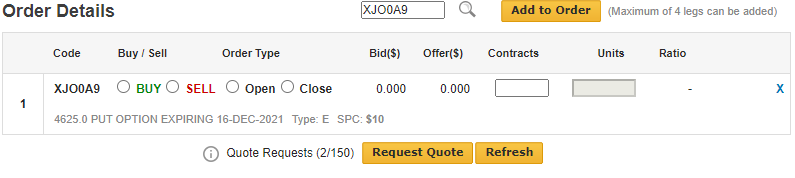

4. When you have decided which Options you would like to quote, enter the Options code and click the Request Quote button, wait 5-10 seconds then click Refresh.

5. You should notice the bid and offer fields are now populated.

6. You can use this quote for assistance placing single-leg ETO orders. View our guide on how to place an options order.

How to request a quote from the multi-leg order pad:

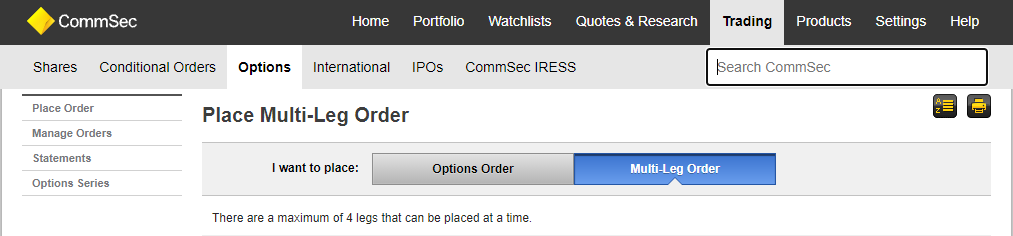

1. After logging in, click on Trading > Options > Multi-Leg Order (Note: you need an ETO account to be able to access this).

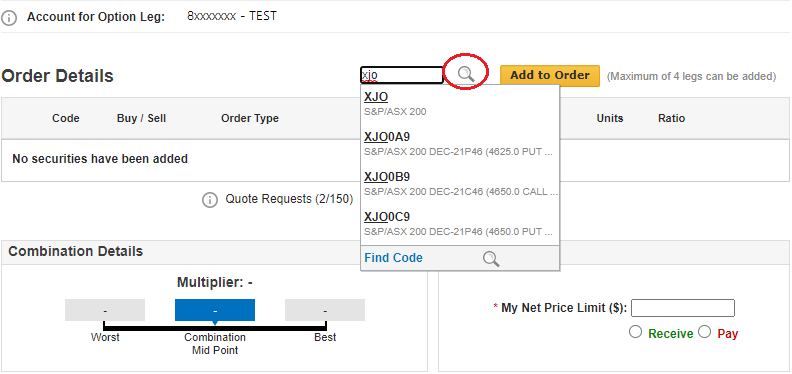

2. If you know the Options code, skip to step 4. If you don't know the Options code and need to search for a specific Options series, enter the underlying code (e.g., BHP or XJO) and click the magnifying glass to search.

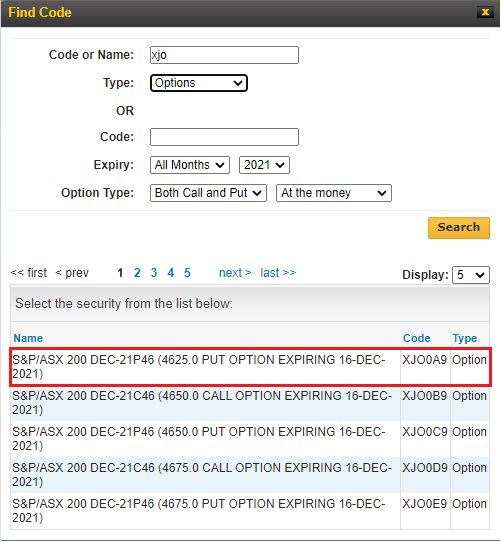

3. Under type, select Options and use the various search filters to find the Options series you wish to trade. From the list, click on the Options series that you are interested in to add it the order details screen.

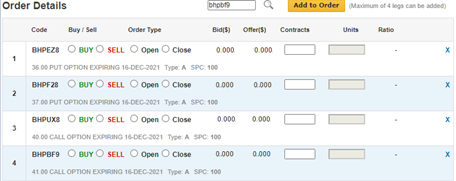

4. When you have decided the Options you would like to receive a quote on, enter the Options code and click Add to Order. It should appear in the order pad as below.

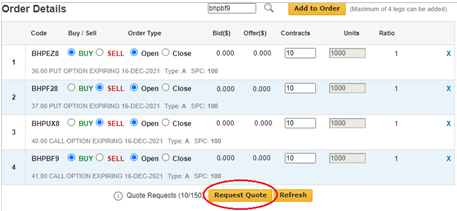

5. You can repeat steps 2 - 4 until up to four legs have been added.

6. Click Request Quote, wait 5-10 seconds then click Refresh.

7. You should notice the bid and offer columns are now populated.

8. You can use these quotes for assistance placing multi-leg ETO orders. View our guide on how to place an options order.

We're here to help

To request Options quotes over the phone or if you require further information, please call the CommSec Options Support on 13 15 19 or if calling from overseas +61 2 8397 1206 (8am to 6pm, Monday to Friday, Sydney time).

Disclaimer

The Exchange Traded Options TMD can be located on the CommSec website.