Why invest in shares?

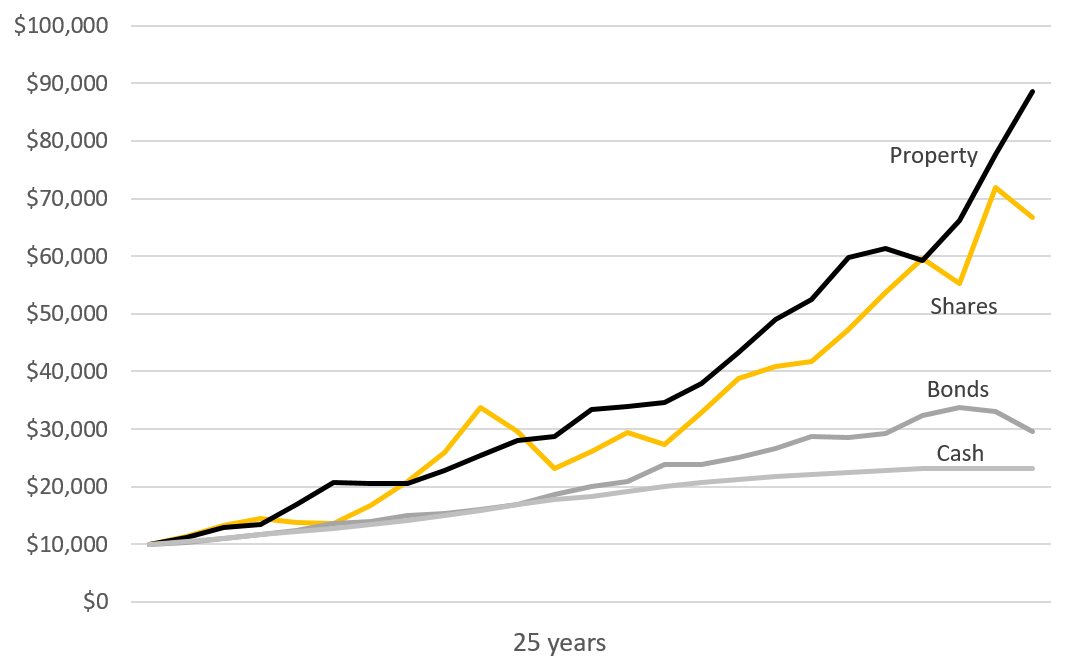

Over the past 25 years, shares have provided better average returns than most other investments1. Plus, you can usually access your money two (2) business days after selling your shares, making them a flexible investment.

All investments involve some risk, and shares are no different. There is the possibility that the companies you've invested in could go out of business, or the share price could fall. If you need to sell your shares at a time when the price is lower than your buying price, you'll make a loss.

There are ways you may be able to minimise your risk, such as building a diverse portfolio of shares from different companies, so you're not putting all your eggs in one basket.